Since the inception of Marketing Automation, the MQL has been a staple in how B2B marketing companies generate revenue.

An MQL is a lead your business has generated, and the possibility of it turning into a customer is higher than other leads. The reason you mark it an MQL is because it has certain demographic characteristics that would suggest it's a good fit for your product/services. Plus, it's also demonstrated an intent to buy via engagement patterns that you track - opening emails, visiting web pages, downloading content.

A PQL is no different, but the engagement patterns come from actual product usage, making it a far more valuable lead. The person has already used your product and got value from it before your sales team ever talk to them.

On this week's GrowthSwipeFile, we discuss the 3 pillars of building a PQL model for your company.

The back-of-the-napkin qualification model for MQLs and PQLs would look very similar:

However, the reason product-led growth and PQLs are rising in popularity is that your product does a lot more of the qualification work.

The Early Days of PQLs at HubSpot

When HubSpot launched freemium tools, we began to experiment with how we could generate PQLs for our sales team.

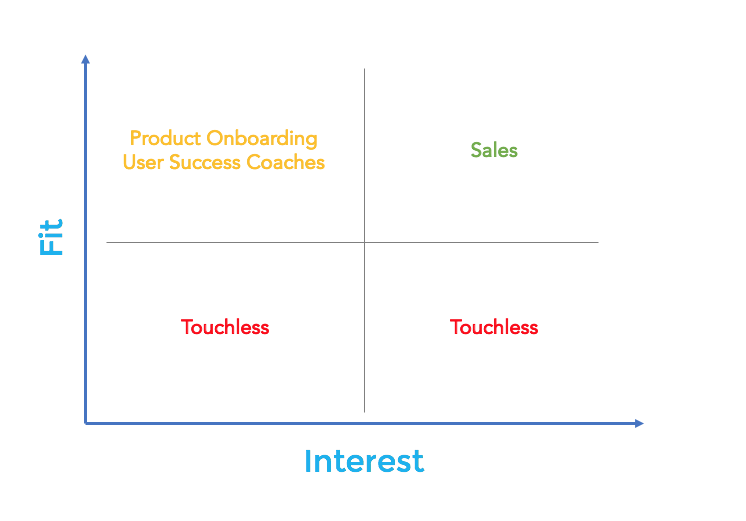

Just like the napkin model above, we segmented users into four quadrants.

Example characteristics for a good fit company and contact were:

a. Company

- Company size between 50 and 200 employees

- The industry is SaaS

b. Contact

- The title was NOT intern or associate

- The email address was not @hotmail.com

Examples of how we used intent:

- They had invited more of their team into the product, and those users had activated.

- They had used some of the features we had identified as being good leading indicators of upgrades (through regression analysis).

That was our PQL score model. We prioritized efforts on upgrading users who were both a great demographic fit AND behavioral fit.

To make our early PQL model successful we had to get 3 things right:

1. Track: How could we measure the PQL model so we could optimize and refine it.

2. Optimize: How could we increase the number for the best converting PQLs.

3. Connect: How could we connect the PQLs with our sales team, and ensure we didn't overwhelm them with bad fit accounts.

Track - An Analytics Feedback Loop

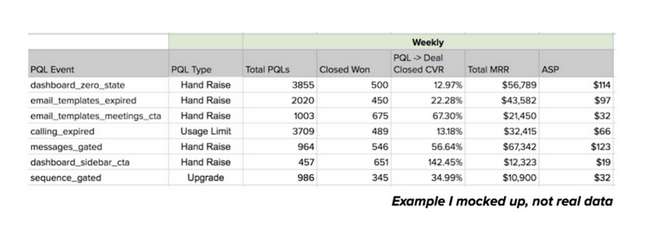

We used event labels to track each PQL, allowing us to build a comprehensive dashboard, including data points like:

- # of PQL Completions

- ASP per PQL

- MRR per PQL

Here is an example of how that dashboard looked:

We would then experiment with how we could get more users to take the actions that had the highest MRR per PQL.

Optimize: - Increasing MRR per PQL

We focused all of our PQL efforts on trying to increase the MRR per PQL. We did this in three ways.

a. Email

b. In-app

c. User Success Coaches

a. Email: We built an email automation system known as "AutoPropsopector" - which was marketing automation written by a copywriter, but sent from individual sales reps. Each email would include a calendar link to that sales rep's calendar, allowing people to book time with them.

It helped us to create meetings for sales reps on auto-pilot.

We had two types of emails:

- Onboarding: we optimized an onboarding sequence from the sales rep to help the prospect get started on some of the features we knew were more likely to lead to upgrades.

- Triggered: certain usage events in the app would trigger an email from a sales rep. Some of these generated a lot of meetings as we were emailing people right at the point they were trying to complete an action. They tended to lead to a lot more engagement.

In-App: We would do various things to get users to do more of the usage events that we knew resulted in the best performing PQLs.

Initially, we added CTA's into the product at specific points to try to get users to complete an action.

As we evolved the model, we transitioned to using in-app notifications triggered at various points during a user's journey. For example, one of the most successful was triggering a notification when a user hit a limit on a feature. The user could book time with a sales rep from within the app to discuss the paid version of that feature, or upgrade via self-serve.

Most of the in-app notifications we experimented with failed because they made the users experience too noisy. It's essential to prioritize user experience over selling.

b. USC (User Success Coaches): Another experiment we did was pair freemium users with human onboarding. Although this can seem counterintuitive, there are ways it can be beneficial to your business.

For example, in episode 113 with Tope Awotona, CEO/Founder @Calendly, he talked about giving customer support to free users. Because Calendly has such an efficient viral loop, the more free users they have using the product, the more those users acquire users for the company. In this way, their customer support costs are a customer acquisition cost.

Using demographic data and some intent data, we were able to connect some of the best fit companies using our free products with user success coaches. We had previously done regression analysis, so we knew what usage patterns resulted in better upgrade rates from free to paid.

That means the coaches could spend their time onboarding users to those features, and doing it through 1 to many mediums like live chat within the product.

Connect: - Good Fit Meetings

The last pillar is how you connect the best-fit users from your freemium pool with salespeople and don't overwhelm them with people not a good fit for your paid plans.

Freemium is great for acquiring a lot of new users. It's also something that can cause your sales team to be inefficient with their time.

For a lot of companies, the solution is simple. As per our napkin model above, you only connect the best fit accounts with sales who have shown the right type of engagement with your product.

The topic that's hotly debated is, should sales work great fit accounts based on demographics, that have yet to show any engagement with your product.

Scott and I debate that topic in the podcast, so make sure you listen :)

iTunes

iTunes Stitcher

Stitcher Spotify

Spotify